Do you know some place where we could put our return envelopes

for supporters to mail back donations?

Tell us where and we'll deliver them.

Donations online are no longer being processed.

|

|

|

12-14-2001 Drop in property taxes may be lessStatewide school levies reduced average amount of cuts

BY PATRICK SWEENEY

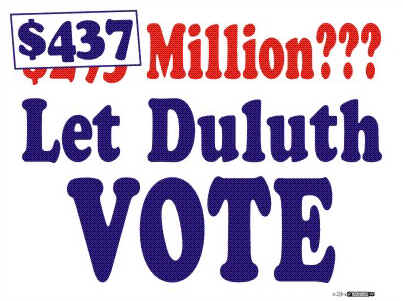

Property taxes across Minnesota next year will not decrease as much as legislators and Gov. Jesse Ventura expected last spring when they approved a major restructuring of the state's tax system, a new Revenue Department analysis predicts. The net tax relief Minnesotans receive -- after big state-mandated cuts by school districts are balanced against smaller increases approved by those districts, cities and counties -- will add up to about $783 million. That is $203 million, about 21 percent, less than the Revenue Department predicted last spring, department officials told members of the Senate Tax Committee Wednesday. For homeowners, the 24 percent statewide property tax cut that legislators and Ventura predicted is turning into an average reduction of 19 percent. That is based on the difference between the property tax bills homeowners will receive in 2002 and those they would have gotten if lawmakers and Ventura had not decided to use state sales and income taxes to pay many public school costs previously borne by property taxes. Homeowners who think of the tax cut as what they paid in 2001 and what they will pay in 2002 will see an average cut of 15 percent. At the end of the Tax Committee hearing Wednesday, chairman Larry Pogemiller, DFL-Minneapolis, served notice that he planned to question over coming months whether the big property tax cuts contributed to the state's projected $1.95 billion budget deficit. "We need to consider if we promised too many chickens in the pot,'' said Pogemiller, one of 11 senators who voted against the tax cuts in June. In response to questions from Sen. Bill Belanger, R-Bloomington, Pogemiller repeatedly said he was not saying -- yet -- that legislators should consider recommending the repeal of some, or all, of the property tax cuts. Belanger said the Republican-controlled House would prevent that. "The Senate could do it,'' Belanger said of a repeal. "The House would refuse to, and it wouldn't get done.'' The Revenue Department's estimate of total property tax relief is based on maximum levies set by schools, cities and counties this fall. When tax rates are finalized, the statewide tax cut will increase, but probably only slightly, Revenue Commissioner Matt Smith said. Larger-than-expected proposed tax increases by schools, cities and counties accounted for almost all the difference between the net property tax reductions that legislators and Ventura promised and those that taxpayers are likely to see. Despite publicity about scores of school boards that sought voter approval for general operating tax increases in referendums this fall, most of the school district, city and county tax increases eating into the promised tax relief are proposed in special tax categories where voters will not get a chance to approve or reject the changes.

|

|